|

Getting your Trinity Audio player ready...

|

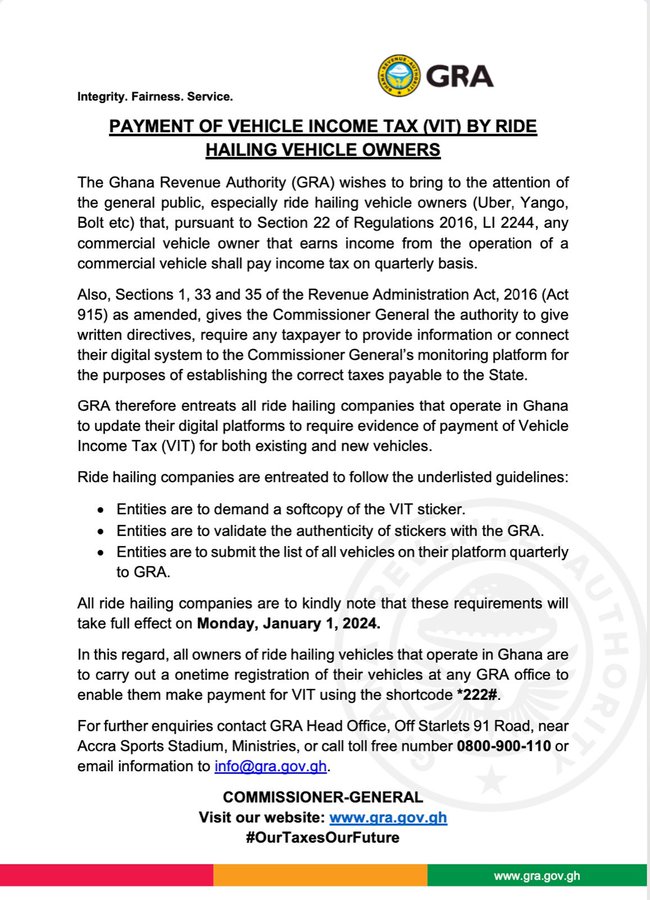

The Ghana Revenue Authority (GRA) has introduced a new tax policy known as the Value Income Tax (VIT), which will take effect from January 1.

The GRA issued a notice stating that the levy is in accordance with Section 22 of Regulations 2016, LI 2244, which stipulates that “any commercial vehicle owner that earns income from the operation of a commercial vehicle shall pay income tax quarterly.”

Ride-hailing companies operating in Ghana, including Uber, Yango, and Bolt, are urged to update their digital platforms to incorporate the new tax requirements.

The guidelines outlined for these companies include the requirement for a softcopy of the VIT sticker, validation of sticker authenticity with the GRA, and quarterly submission of the list of all vehicles on their platform to the GRA.

The GRA emphasized that these requirements will be enforced starting January 1, 2024. Vehicle owners in the ride-hailing sector are also required to register their vehicles at any of the GRA offices to “enable them to make payment for VIT using the shortcode *222#.”

The introduction of the Value Income Tax aims to ensure that commercial vehicle owners operating within the ride-hailing sector contribute their fair share of income tax. This move is part of the GRA’s efforts to enhance tax compliance and revenue generation in the country.

In response to the new tax policy, ride-hailing companies are expected to implement the necessary changes to their platforms to accommodate the VIT requirements. The GRA has provided a clear framework for compliance, and vehicle owners are urged to adhere to the guidelines to avoid penalties.

Read the full details of the statement issued by the GRA: