|

Getting your Trinity Audio player ready...

|

Macroeconomics and fiscal gains are relevant benchmarks for assessing the performance of a country and the livelihood of its citizens. According to the World Bank, macroeconomics combines various policies, resources and technologies to develop the economy resulting in poverty alleviation and social equity. Fiscal policy on the other hand monitors the actions of governments in managing revenues, expenditures, and debt to ensure the attainment of a healthy economic growth in their quest to develop the country. The relationship between revenue and expenditure is therefore critical for policy makers as it determines the fiscal surplus or shortfall resulting in an overall macroeconomic stability.

The ordinary Ghanaian, irrespective of the stable macroeconomic indicators and fiscal discipline by governments, generally require a sustainable social and economic wellbeing, which include but not limited to increase in their income levels, purchasing power, job satisfaction, financial security, safe accommodation, sound education system, health and safety. Ghana in the recent past has seen some macroeconomic and fiscal gains such as achieving a consistent single digit inflation from July 2018 to March 2019 (9.3%), relatively stable currency, decline in interest rates with policy rate at 16%, increase in GDP to GHC 256bn and increase in economic growth of about 6.3% in 2018.

The most common commentary in the country lately is the fact that the stable macroeconomic indicators and fiscal discipline enumerated does not reflect in the pockets of the ordinary Ghanaian. This commentary has been met with mixed responses with some schools of thought questioning whether the sentiments shared by some Ghanaians are valid, others also suggests the sentiments are political in nature, while others are also questioning the fundamentals of the macroeconomic indicators. Therefore, the big questions to be addressed in this article are:

- What does having stable macroeconomic indicators mean to the country and its citizens?

- Does having stable macroeconomic indicators necessarily mean the livelihood of citizens should change immediately?

- Should the macroeconomic indicators exist for a consistent period for its benefits to be felt in the pockets of the ordinary Ghanaian?

This paper delves into the drivers and components of the various macroeconomic indicators and the changes necessary in these indicators to impact the lives of the ordinary Ghanaian.

GROSS DOMESTIC PRODUCT (GDP)

GDP is one of the most common macroeconomic indicators that can be used to measure the standard of living of a society. GDP measures the economic activity of a region or a country at a given time providing a snapshot of its performance. GDP in general has been identified to have a relationship with the standard of living in the sense that most of the migration in the world involves people who are moving from countries with relatively low GDP per capita to countries with relatively high GDP per capita. It has however been argued that the use of GDP alone is unable to provide us with a realistic measure of the distribution of wealth among the population. This is because only a small proportion of the society may be benefiting from an increase in GDP and may not be affecting the standard of living for most of the citizens.

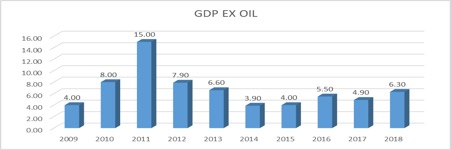

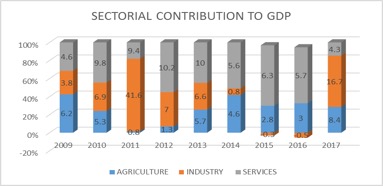

The economic growth in relation to GDP over a 10-year period has witnessed an inconsistent trend showing some up and downs. Agriculture, Industry and services are the three (3) major sectors of the economy that affects GDP. For the past ten years, the GDP contribution by the service industry has been significant up until 2017 when GDP growth in the service industry fell to 4.3% mainly due to the sanitization of the banking industry which resulted in the winding up of some banks, job losses and increase in the Debt to GDP ratio of the country among others.

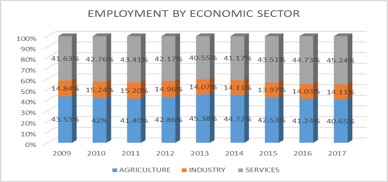

The GDP growth from 2017 was underpinned by increased crude oil production, relative stability in energy supply and the implementation of pro-growth government initiatives. The improved GDP outturn was driven mainly by Industry while Services and Agriculture followed respectively. It is worth noting that even though the GDP growth was influenced greatly by the industry sector, that sector only employs 14.11% of the working force whereas the agricultural sector employs 40.65% of the work force but contributes to GDP minimally in comparison to the industry sector. This implies wealth distribution in the country may be concentrated among a few Ghanaians in specialized sectors such as mining, oil and gas, reinforcing sentiments that the increase in GDP is not reflecting in the pockets of Ghanaians though the fundamentals supporting the indicator is accurate. The ordinary Ghanaian would only benefit from these specialised sectors through the Government’s use of taxes from these institutions.

In addition, Ghana’s growth target for 2019 is projected at 7.4% to be mainly driven again by the industry sector which is expected to improve to 9.7%; indicating that the concentration will continue to persist until a period when agriculture and the service sector that employs about 80% of the Ghanaian workforce become key drivers of GDP growth for majority of Ghanaians to realize a positive change in their pockets.

EXCHANGE RATE

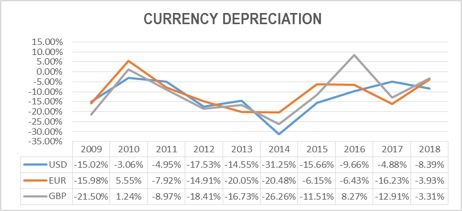

Exchange rate fluctuations is also a factor that has the ability to affect the standard of living of the ordinary citizen. The cedi, over a 10-year period, has generally depreciated against the three major trading currencies averaging an annual depreciation of 12% for the USD, 10% for the GBP and 11% for the EUR. Fluctuations in the currency of a country is as a result of the use of a floating exchange rate system that permits factors such as demand and supply, inflation, capital flows, interest rate differentials, the performance of the economy and other foreign pressures to determine the price of the currency.

The ordinary Ghanaian is directly affected by exchange rate fluctuations, as most goods are imported, and such fluctuations will alter the prices of imported goods and services that will eventually be passed on to the final user that is the citizen. Importers may however be affected the most if they are unable to factor in the full cost of depreciation of the currency in their pricing for fear of losing demand for their products.

INFLATION

Inflation is generally the persistent increase in the prices of goods and services over a period of time. This simply means you have to spend more for instance to buy a carton of milk, fuel your tank and buy a bag of rice without compensatory increases in income levels. Inflation increases your cost of living whiles reducing your purchasing power thus explaining why it is an obvious factor in determining the standard of living of the ordinary Ghanaian. President Reagan, buttressing the fact that inflation cannot be overemphasized, has even described it as a mugger, arm robber and a deadly hit man.

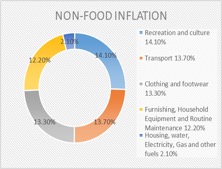

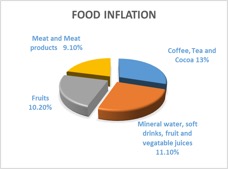

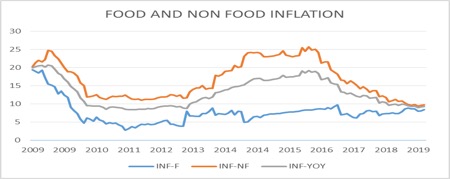

Ghana has witnessed a continuous single digit inflation from July 2018, which currently stands at 9.3% as at March 2019, within the Government inflation target of 8+/-2%. The main drivers of inflation for the past ten years have been food and non-food inflation. Non-food inflation even though it has recorded a steady decline in the past ten years is always higher than the food inflation. Generally, with inflation reducing, it is expected that the average increase in the price of goods and services should increase at a reducing rate. With inflation properly anchored, it is expected that this would also reflect positively in the finances of Ghanaians as the prices of goods and services are expected to increase at a decreasing rate.

For the rich and middle class in society such price changes may not affect them as they have the capacity to absorb the increase in price. For the poor in society who live just at the edge of the poverty line, a slight change in the prices of goods and services would have an impact on their lives. According to the Bank of Ghana, the downward inflation trends is mainly influenced by the permanent components of the Consumer Price Index (CPI) basket coupled with further easing pressure in housing and utilities, and transport prices. It is worth noting that key areas of concern to majority of Ghanaians; Recreation and culture, Transportation, Clothing and Footwear, Furnishing, Household Equipment and routine maintenance in March 2019 recorded a higher year on year inflation higher than the group’s average. This may explain sentiments by some Ghanaians that the single digit inflation is not reflecting in their pockets as key areas of concern are seeing inflation increasing at an increasing rate compared to the overall core inflation.

Though Inflation was lowest in the Housing, Water, Electricity, Gas and Other Fuels subgroup (2.1%), the rate of change has been minimal, and that subgroup only contributes 2.1% to the total. Also, the daily minimum wage in Ghana has seen a year on year increase of 10% from 2017 to 2019. Over the same period inflation also ranged averaged at 10.17%. This therefore would mean that increments in the income levels would be wiped away by the degree to which prices of goods and services had increased. Thus, Ghanaians would not feel the impact of any increment in their pockets and their standard of living generally. This notwithstanding, it is argued that, inflation alone cannot influence the wellbeing of citizens.

INTEREST RATE

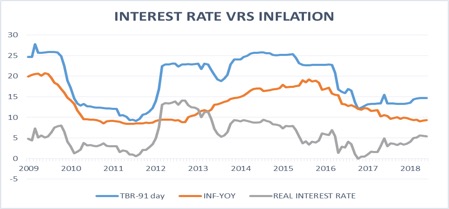

The trend in interest rates over the past 10-years has seen a significant decline. The downward trend in interest rates over the period was supported by the continuous decline in the monetary policy rate from 26% in 2016 to 16% in 2019 coupled with the decline in lending rates in the banking industry.

The decline in interest rates is expected to reduce the cost of borrowing in the country with a ripple effect on the living standards of Ghanaians. As the cost of borrowing reduces, it is also expected that the prices of goods and services will decline as local producers and service providers are able to access funding at a lower cost, which translates into their cost of production. This then has the ability to improve the purchasing power of Ghanaians all other things being equal. Loan and advances in the banking sector shows concentration of loans in Commerce & Finance (25.2%), Services with (21.1%) and Construction with 11.0%. The three sectors with the lowest shares of banking industry credit were Manufacturing (8.1%), Agriculture, Forestry and Fishing (4.1%), and Mining and Quarrying (3.0%). This indicates access to funding is less available to sectors that employ majority of Ghanaians thus explaining concerns that most Ghanaians are not feeling the effect of the decline in interest rates in their pockets even though interest rates are evidenced to be declining in the banking industry.

Real interest rate is another significant factor that can affect the standard of living for the Ghanaian investor who invests purposely for immediate income. Averagely the real interest rate for a 10-year period was at its highest in 2012 and 2013 at 9.6% and 10.4% respectively reducing to its lowest of 1.74% in 2017 with the current real interest rate average at 5.52%. Previously the real return was high thus an incentive to invest funds as against putting the funds into a business venture, but this would in the long run not stimulate economic growth. As real return reduces, immediate income for investors also reduces thus investors may not be able to feel the impact of the stable interest rate benefit in their pockets if their expenditure levels, taste and preferences, remain same over time.

Interest rates in the West African sub region averages about 8.5%. Ghana’s interest rates are therefore very high in comparison to countries such as Benin, Burkina Faso, Ivory Coast, and Senegal who offer interest rates of about 4.5%. The high interest rates may thus be a source of competitive disadvantage as investors looking to set up industries may prefer to set up in neighbouring countries and be able to assess financing at relatively cheaper rates. Other factors such political stability and availability of skilled workforce affects investors’ choice though.

GOVERNMENT FISCAL PERFORMANCE

The borrowing and expenditure patterns of the government have been identified to also have an impact on interest payments and the standard of living. Government’s ability to raise the needed revenues is a major determinant in its quest to implement policies and programmes that improve the living standards of Ghanaians. Over the years, it has been identified that the major source of revenue for the government is taxes whereas its largest expenditure item for the period is compensation of employees. It can directly be inferred also that total revenue generation would not be able to cover our entire expenditures and the deficits are financed both domestically and externally. Questions thus arise on how Government’s proposed expenditures should be financed and whether it is prudent for the government to borrow to pay salaries, interests on previous government borrowing and capital expenditure.

Comparisons made to other countries in the sub-region revealed a similar trend in the borrowing and investment patterns. In view of this, African countries are encouraged to regularly recalibrate their fiscal policies to focus on increased revenue collection and take into account business cycles and sources of repayment while diversifying borrowing sources to prevent adverse effects on macroeconomic stability.

Tax-to-GDP ratio is the ratio of a country’s tax revenue in relation to its GDP which is mostly a very relevant parameter in addressing budget deficits and deficiencies. Sub-Saharan Africa has been experiencing a significant shortfall in financing for investment. The average ratio of tax revenue to GDP for sub-Saharan Africa stood at 15.1% in 2018; with Ghana’s at 13.1% which is even below the African average. Even though this is a significant improvement over the years this ratio falls short of the desired level and remains below the average ratio of 24% for the OECD countries. Ghana is therefore expected to strive to ensure that tax revenues hits 20% of gross domestic product (GDP) which can be done through the strengthening of tax capacity and improving governance in revenue collection.

Government social intervention policies

The extent to which government should be involved in the provision of goods and services that promote citizen well-being is a perennial debate worldwide today. While others support government interventions such as generous unemployment protections and welfare benefits other believe minimal government intervention will allow the market to operate most efficiently and attain equilibrium. In Ghana, governments have introduced special interventions such as the Livelihood Empowerment against Poverty (LEAP) programme which provides cash and health insurance to the extremely poor households across the country to alleviate poverty in the short-term. Such interventions have often being criticized because of their short term nature and their inability to solve extreme poverty conclusively. It is also seen as a conduit to increase unemployment especially among the poor who otherwise could have engaged in productive sectors of the economy. Governments today are therefore implementing innovative interventions that tend to increase economic growth while alleviating poverty by channelling the funding to other productive sectors of the economy which would yield a higher return. In Ghana, Growing to Feed the Nation is a social intervention programme that supplies farmers with the requisite farm inputs for free with the expectation that production will be increased and poverty will be alleviated through the creation of jobs. The production from this project affects local consumption, reduces the importation of similar produce, possible value addition and exportation of excess produce thereby generating foreign currency that can help to stabilise the currency. Thus such projects are expected to yield results that far exceed the investments made in them thereby not eroding gains made from economic stability to excite citizens unduly.

Distribution of Government expenditure

The distribution of expenditures among the key sectors of the economy provides a snapshot of government’s priority areas and their direction in terms of economic development. From the recent 2019 budget, the expenditures were distributed among seven (7) main segments namely administration, economic, infrastructure, social, public safety, multi sectorial and other government obligations. Government obligations alone represented 49% of the total expenditure leaving 51% to the remaining sectors. Citizens of a country are interested mostly in the sectors that are able to provide them with improved conditions of living and such sectors of concern here in Ghana will be the Social (23%), Infrastructure (6%) and Economic (4%) sectors. Ghana is committed to the education and health with the social sector which is evidenced by a high level of expenditure allocation to provide relief in terms of free education, provision of educational infrastructure, universal health coverage, provision of health facilities and recruitment of qualified educational and health professionals. Other areas such as sanitation, transport, roads and highways, works and housing, special development initiatives and inner city and Zongo development also had their share of the public cake even though not so much as would have been expected. But then again, expenditure allocation for government obligations should be properly managed to free up funding to be reallocated to the economic sector to propel sustainable growth.

CONCLUSION

In the light of the above, it may be inferred that some sentiments by Ghanaians on the stable macroeconomic indicators not reflecting in their pockets may to some extent be valid, however, sentiments on the fundamentals and the fact that the indicators are political in nature may not be established as key data supports these indicators.

Key interventions by governments, for example, the current government flagship programs for the developments of the agricultural and manufacturing sectors are to be critically exploited to increase employment, exportation of value-added products through manufacturing and foreign direct investments. These activities have the ability to generate foreign currency to increase our gross international reserves and stabilise the currency. Subsequently, an improvement in the agriculture, manufacturing and services sectors may result in wealth being equitably distributed.

A major challenge faced by developing countries is often the ability to identify and carry out macroeconomic policy reforms that foster growth and reduce poverty. Government is therefore encouraged to maintain a high level of fiscal discipline within the approved cap of 5% of GDP and avoid excess deficit financing.

In furtherance to the above, there should be civic involvement to deepen commitment to macroeconomic reforms to avoid policy reversals. In recognizing this, the ordinary Ghanaian should be involved in making governments responsible for the adoption and execution of sound macroeconomic policies to alleviate poverty and improve the standard of living for Ghanaians.

By: Akofa Dakwa | The writer is the Head of Treasury at the Bank of Africa Ghana Ltd. She is a Chartered Banker, a Certified Financial Markets Dealer and holds an MBA in Finance and Risk Management.

SOURCES

- Akofa Dakwa – Head of Treasury at the BANK OF AFRICA, Ghana Ltd

- Bank of Ghana: https://www.bog.gov.gh/

- Ministry of Finance: https://www.mofep.gov.gh/

- Ghana Statistical Service: http://www.statsghana.gov.gh/

- World Bank: http://www.worldbank.org/

- Statista: https://www.statista.com/

- https://www.uneca.org/sites/default/files/PublicationFiles/era2019_eng_fin.pdf