|

Getting your Trinity Audio player ready...

|

The Chief Executive Officer (CEO) of Dalex Finance

Ken Thompson has advised the government against intervening to stop the depreciation

of the cedi.

According to him, supporting the cedi prevents the right investment decisions from being made as well as “prevents us from changing our consumption habits and put our food security at risk by reducing the price of imported food and making our local food production expensive and uncompetitive.”

“Let the cedi fall to reflect its true value to help promote local food crop farming and exports,” Mr Thompson stated in a statement warning: “Unemployment and poverty will continue to rise unless we start reducing the level of food imports and increasing local food production.”

He continued: “If we continue to import food, one day we will lose our ability to produce food altogether and if our trading partners get upset with us, we will starve.”

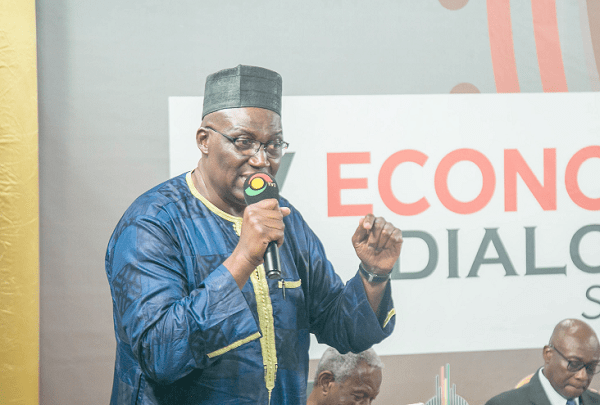

Meanwhile, Vice President Dr Mahamudu Bawumia on Wednesday blamed the recent depreciation of the cedi on directives from the International Monetary Fund (IMF) to the Bank of Ghana.

The cedi recently hit an all-time low recording a rate of GH¢5.86 to a $1.

The depreciation of the cedi against the dollar, according to the Minority added some GH¢15.3billion to the country’s external debt stock.

The cedi since last month, however, begun recording some marginal appreciation closing at around GH¢5.56 against the dollar on March 15, 2019.

Speaking at a maiden Town Hall Meeting of the Economic Management Team in Accra Wednesday, Dr Bawumia said: “The most important and the proximate cause of the recent depreciation is the time inconsistency of an IMF prior action on the reserves target.”

He said the IMF at the end of January gave Ghana seven actions to complete before March 15.

“One of the conditions that the Bank of Ghana had to meet was to increase its net international reserves to the level of December 2018. To increase the net international reserves, however, meant that the Bank of Ghana could not sell any foreign exchange in the market. They had to essentially hold their hands to the back and could not intervene on the market during this particular period.

“So demands for foreign currency was not met by supply as normally happens on a day-to-day basis, and we know when the demand is greater than the supply or the supply is not coming, the price will go up and this exactly what was happening,” he said.

Source: Daily Mail Gh Staff