|

Getting your Trinity Audio player ready...

|

The Ghana Cocoa Board (COCOBOD) says the call by the International Monetary Fund (IMF) that it should reduce the producer price of cocoa “makes economic sense.”

However, the COCOBOD said any attempt to heed that call would mark the beginning of the collapse of the country’s cocoa industry.

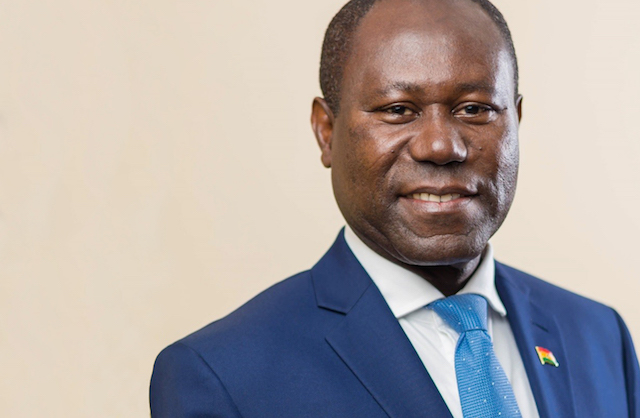

In an interview that discussed a range of issues on the producer price of cocoa and cocoa sustainability in Ghana, the Chief Executive Officer of COCOBOD, Mr Joseph Boahen Aidoo, said any attempt to “reduce the price by even GH¢5 will spell doom for the industry.”

Such a reduction will motivate farmers to relinquish their cocoa farmlands for illegal mining, rubber and cashew plantations to the detriment of the cocoa industry, Mr Aidoo said.

He was responding to an advice by the IMF to the board and the government to adjust the producer price of cocoa downwards to reflect global trends.

The fund said the reduction was necessary to ensure that COCOBOD did not expand its financing gap estimated at GH¢1 billion.

“The proposal of the IMF makes sense economically but the decision does not have to be made based on the economics of it alone; we have to weigh the social and the environmental effect also.

“So, our decision to maintain the price is based on the determination that the environmental and the social impact outweigh the economic effect as being suggested by the IMF,” he added.

On the IMF’s advice that the government could use “explicit budget transfers” to cushion farmers’ incomes from the impact of a producer price reduction, Mr Aidoo said “it does not make any difference.”

“That is like robbing Peter to pay Paul,” he said, explaining that the cost of that mechanism would still be borne by the state.

“Meanwhile, when you reduce the price, you sort of send a bad signal that will motivate the farmers to give out their farms,” he added.

Justification

In view of the consequences of the downward adjustment of the producer price of cocoa, Mr Aidoo said the board was justified in keeping the price paid to cocoa farmers at GH¢7,600 per tonne for two years in a row at a time prices of the crop had fallen by an average of 40 per cent on the world market.

He, however, explained that in the unlikely event that prices dropped below a danger level, the board, the government and the farmers “will have to sit and take a decision.

Until then, Mr Aidoo said, the board and the government would continue to keep the price at GH¢7,600 per tonne while intensifying the productivity-enhancing programmes (PEPS) to help protect farmers’ incomes.

Cost of ‘galamsey’

COCOBOD’s CEO said unlike other cocoa producing countries, Ghana’s cocoa sector was competing with illegal mining, cashew and rubber plantations for the same land.

To worsen the situation, he said, productivity in the sector had been low, making it easier for farmers, most of whom were past 50 years, to relinquish their cocoa farms for other ventures that could fetch them comparatively higher incomes.

He revealed that a survey by the board found that substantial amounts of cocoa lands in the Eastern Region and the previously called Brong Ahafo Region had been lost to cashew and rubber plantations, leading to a decline in contribution to national output from those areas.

“When you go to Weichi in the Brong Ahafo Region, the large tracts of cashew farms you see there now used to be cocoa farms, but because of the low productivity and loss of interest in cocoa farming, farmers started converting their farms to cashew farms,” he said.

“So the justification (for maintaining the price) is that we had to actually put measures in place to sort of bring a break to the way the industry was losing land to illegal mining. Because if the price of cocoa had been reduced in 2017 by even GH¢5, when cocoa prices on the world market fell by more than 40 per cent, most cocoa farmers would have sold their land to illegal miners,” he said.

Financial gap

Mr Aidoo said that was not the first time a global body was concerned about Ghana’s unwillingness to reduce the producer price to correspond with world market prices.

He recalled that the World Bank, the World Cocoa Foundation, the International Cocoa Organisation and even peer cocoa growers had asked the COCOBOD why the country was keeping its producer price intact when global prices were falling.

Apart from Ghana, almost all the 50 cocoa growing countries worldwide have reduced their cocoa producer price to reflect the fall in the price of the crop internationally.

COCOBOD’s CEO said Ghana’s decision came at a cost.

In the 2017/18 cocoa season, when global prices of the crop fell by more than 40 per cent, he said the board recorded a financial gap of GH¢2.03 billion.

It, however, narrowed to the current GH¢1 billion as a result of modest improvements in the price in the 2018/19 season, he said.

Source: Daily Graphic