|

Getting your Trinity Audio player ready...

|

An Accra High Court has ordered the Bank of Ghana, the Attorney-General and the Receiver of GN Saving and Loans Limited to file their defences in response to Dr. Papa Kwesi Nduom’s case. The Court has given the three Respondents one month to file their defences.

At today’s Court hearing, the Human Rights judge, Justice Gifty Addo Adjei, referred to Chapter 5 of the 1992 Constitution and stated that the action before her is a fundamental right action. She used the persuasive statement of Judge Mensah Akomeah in the Dr Kwabena Duffour vrs BoG case and overruled for want of legal basis. In effect, the High Court has ruled that it has jurisdiction over the case and has adjourned it to 21st January 2020 for judgement on the substantive application.

The Revocation

It would be recalled that on August 16, 2019, the Bank of Ghana issued a notice to revoke the licence of GN Savings and 22 other savings and loans companies and finance house companies for various reasons.

In respect of GN Savings, however, the Bank of Ghana stated that “GN is currently insolvent under Section 123(4) of the Banks and SDIs Act, 2016 (Act 930).”

In the same notice, the Bank of Ghana appointed Mr Eric Nana Nipah, a Partner at Pricewaterhouse Coopers Ghana, as Receiver to see to the liquidation of the companies.

Nduom’s case

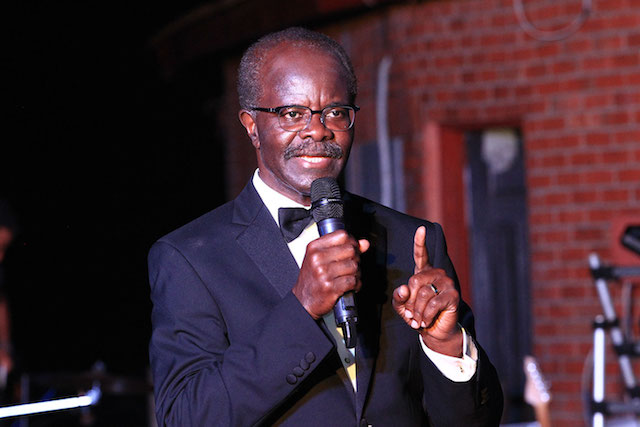

However, on August 30, 2019, Dr. Papa Kwesi Nduom and the other shareholders of GN Saving, through their lawyers, Archbridge Solicitors, filed an application at the High Court to challenge the revocation of GN Savings’ licence.

In the suit, the lawyers rejected the Bank of Ghana’s claim that GN was insolvent. They also described the revocation as “malicious”. The lawyers explained that the Bank of Ghana deliberately refused to consider the entire portfolio of GN Savings’ assets in coming to the conclusion that GN Savings was insolvent. They prayed the Court to, among other things, quash the decision of the Bank of Ghana and to restore GN Savings’ licence.

They also filed an application for interlocutory injunction asking the court to restrain the Bank of Ghana and the Receiver from acting in a way that may overreach the court’s powers or prejudicing their case.

The Respondent’s Objection

Rather than oppose the case and give reasons for their decision, the Bank of Ghana, the Minister of Finance and the Attorney-General chose to object to the jurisdiction of the Court.

They argued that the proper place to challenge the revocation was the Ghana Arbitration Centre and not the High Court.

Dr Nduom’s lawyers, led by the Justice Srem-Sai, opposed the argument. In his oral address to the High Court on November 21, 2019, Mr Srem-Sai argued that his clients are entitled to choose which forum to go to for remedies. He submitted that the High Court has firm jurisdiction over the case. He finally prayed the Court that the objection was baseless and should be dismissed with exemplary cost.

Secret Memo

Meanwhile, documents have emerged this week suggesting that the decision to revoke the licences of Dr Nduom’s business establishments were politically motivated.

In one of the documents (published by the Daily Post newspaper) had the Minister of Finance, Hon. Ken Ofori Atta, urging Cabinet to approve the scheme to revoke the licence of GN Bank.

The memo also asked for Cabinet’s support for the Bank of Ghana throughout the revocation process. The memo described Dr Nduom as a “threat” to the Nana Akufo Addo government’s interests.

Way Forward

Having dismissed the objection of the Bank of Ghana and the Attorney-General, the case is now set to take its normal course. The Respondents will have no choice but to justify their decision to revoke GN Savings’ licence.

Source: Daily Mail GH