|

Getting your Trinity Audio player ready...

|

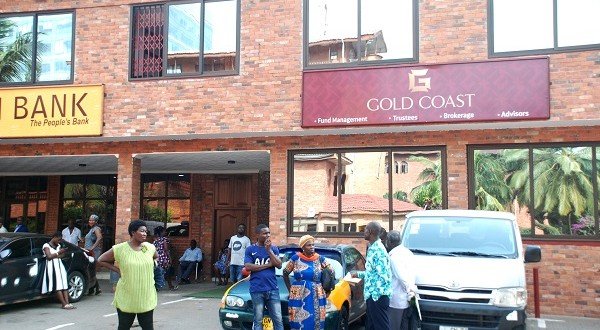

Gold Coast Fund Management (GCFM) welcomes confirmation by the Security and Exchange Commission (SEC) that it is seriously engaging with the company to find a lasting solution to the liquidity crisis faced by it.

The Commission has revealed they have received and started reviewing proposals from GCFM, the biggest fund manager, on how they hope to meet payment obligations to their customers and investors.

The news came via a statement released by the SEC which said, “The Commission is presently reviewing the viability and soundness of the proposals and wishes to assure all interested parties that it is doing so only in the interest of investor protection.

GCFM has expressed optimism that the approval of its proposal would give their clients real value for their investment and provide a roadmap for other struggling fund management companies seeking solutions to their liquidity challenges.

General Manager, External Affairs and Investor Relations, Benjamin Afreh, said “we submitted Cardinal Offer as an investment option to our Structured Finance Product. We believe the Cardinal Offer will give our customers real value for their investment while helping to mitigate our liquidity challenges”

“The Cardinal Offer will be a medium to long term, liquid and value enhancing product. It will be made up of a bond and an equity offer. The bond portion of the fund will allow customers to continue to earn a predetermined return without violating the recent directives from the commission. By this, we are offering a solution to the SEC directive by leveraging on this investment asset”, added Afreh.

GCFM has so far paid nearly GHS70 million to aggrieved customers and various categories of clients and has shared details of these payments with the regulator.

In addition, GCFM is one of the few if not the only fund manager to have ceased taking new deposits for its Structured Finance product from investors since October 2018, in compliance with the regulator’s directive to the fund management industry to stop offering guaranteed rates.

The company is also taking firm and urgent steps to recover investments placed with other financial institutions and government infrastructure products. When government agencies pay contractors for work done, it will restore normal operations for GCFM.

Source: Daily Mail GH