|

Getting your Trinity Audio player ready...

|

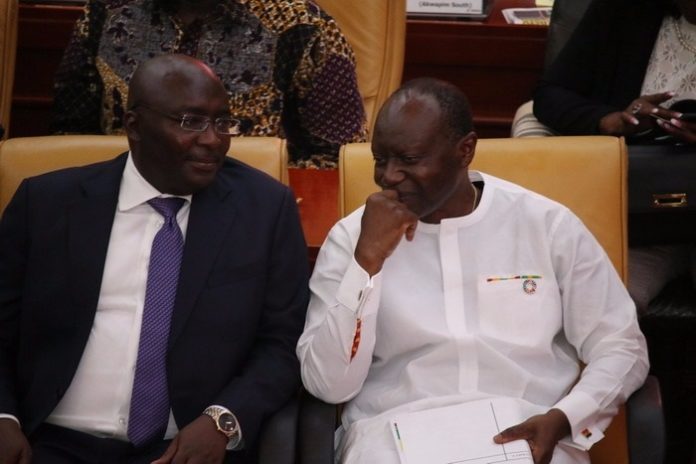

The Ghanaian economic discourse pre-COVID-19 was dominated with statements that characterized the Ghanaian economy as a “Resilient Economy” – an economy that could withstand adverse shocks and still manage the economic costs associated with such turbulence. Such claims were parroted by the lead economic managers, especially the finance minister, Mr. Ken Ofori Atta and the vice president, Dr. Mahamudu Bawumia.

An economy, simply put, is a system within which natural, human and man-made resources are transformed efficiently through technologies into goods and services for distribution among economic agents so as to maximize welfare as well as corporate profits. Thus, the Ghanaian economy is one that leverages on various technologies to transform the gold, crude oil, cocoa, timber, cereals and tubers, etc. into products that meet the aggregate demand and enhance the wellbeing of the populace.

However, events of March and April 2020 have exposed the country’s so-called economic resilience as one that was just mirage. On the economic management front, fiscal challenges required government to quickly re-cap the stabilization fund downwards to free about Gh¢1.2 billion for the use of central government. The Government of Ghana (GoG) also returned to the IMF with an emergency request for Rapid Credit Facility (RCF). The GoG presented some selected economic and financial indicators that led the IMF to the conclusion that there were significant risks to Ghana’s macroeconomic outlook.

According to the IMF, “Ghana continues to be classified at high risk of debt distress.” The debt to GDP ratio had also deteriorated by 4.2% (59% to 63.2% from 2018 to 2019) and projected to worsen to about 69% in 2020, excluding ESLA bonds. Fiscal deficit deteriorated from -7% of GDP in 2018 to -7.5% in 2019 and is projected to further decline to -9.5% inclusive of financial and energy sector costs. Primary balance, a critical domestic anchor for debt sustainability, also deteriorated from -1.1 in 2018 to -1.8 in 2019 and projected to close year 2020 with -4.1. The IMF rapidly approved an RCF of $1 billion (equivalent to Gh¢5.6 billion at the prevailing interbank exchange rate) as loans to the GoG.

With Ghana’s fast declining foreign reserves (projected as $3.9 billion supporting 1.9 months of import cover ending year 2019) and GDP growth rates on the downward economic trajectory, one cannot help but seek answers to the kind of economic resilience touted in recent years by Dr. Bawumia and Mr. Ken Ofori Atta.

If the strong correlation between the quality of government and its observed capacity for resilience to economic shocks, as hypothesized, is to go by, then the current government, by its hunger to deplete the stabilization fund, resort to the IMF for loans that are bigger than the Mahama regime took from the IMF as well as the suspension of the Fiscal Responsibility Act as interim measures to cope with the imminent shocks to the economy implies that the economy pre-COVID was ailing than resilient and the economic managers engaged only in rhetorics.

By Ibrahim Yahaya, Baatsonaa | The views expressed by the writer are solely his and do not represent the position of Daily Mail GH