|

Getting your Trinity Audio player ready...

|

The Cash-lite dream has been the core objective of many countries in the World due to its:

1. Socioeconomic benefits.

2. Safety and security of Cash flow.

3. Uninterrupted rotation of Cash from one wallet to the other.

4. Convenience, reliability and reachability of Cash.

5. Easy tracking and monitoring of Cash flow.

6. Fight against money laundering.

7. Effectiveness and efficiency.

Cash-lite Policy is aimed at reducing(not eliminating) the amount of physical cash circulating in the economy and encouraging more electronic-based transactions.

The National Lottery Authority(NLA) through a collaborative engagement with the Ghana Revenue Authority (GRA), Banks, Telecommunication Companies, Ghana Water Company Limited, Power Distribution Services Ghana(formerly ECG) and other agencies are set to roll out a full Cash-lite System in the Country.

The NLA’S Cash-lite Policy would ensure Interoperability between bank accounts, mobile money wallets, Point of Sales Terminals, VAT and other electronic payment platforms.

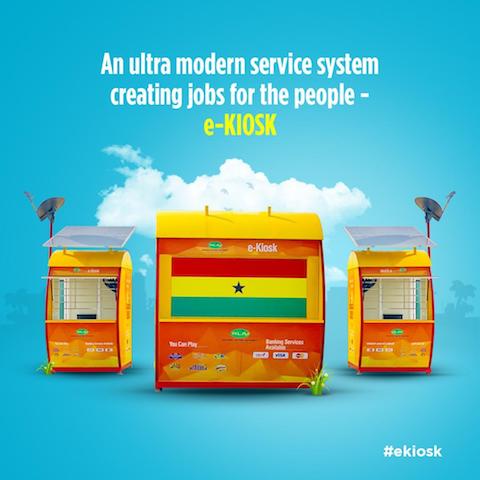

One of the practical ways to improve digitalization and digitization of the Ghanaian Economy would be through the Solar-powered E-kiosk Business Model.

Ghana has the baseline infrastructures such as RTGs, ATMs and POS Switches coupled with a Mobile Money Interoperability for the purpose of achieving a Cash-lite economy, however, Ghana is still very much a cash dependent Society. A Cash-lite Economy has been a long awaited dream for Ghana and the E-Kiosk platform would lead in ensuring the realization of that dream.

The Payment and Settlement Act passed by Parliament in March this year does empower Bank of Ghana to establish, operate and promote any course that thrive the electronic payments system in the Country.

The Ghanaian payment governance is driven primarily by Bank of Ghana together with Ghana Interbank Payment Settlement System(GhIPPS) being the delivery arm. Although, under this umbrella, the Country has chalked quite some success in electronic payments but still not adequately enough to propel the Country into a Cash-lite Society, physical cash transaction is still very common in Ghana.

The National Lottery Authority currently has about 10, 000 Sales Centers across the Country and coming on board the Solar-powered E-kiosk, the Authority is aiming at having about 40, 000 Sales Centers, one per Polling Station and Electoral Areas. This approach of business model will provide easy accessibility, availability and reachability to Customers.

Indeed, the solar-powered E-Kiosks would help to Usher Ghana into a full Cash-lite Society and, in addition creates over 100, 000 jobs for Ghanaians especially the youth.

The solar-powered E-Kiosk is expected to be the game changer in the Financial System of Ghana thereby making Ghanaians to enjoy a full financial inclusion